The US dollar has been the world’s reserve currency for many years. It has been the standard for international trade and is used as a currency in many countries. However, the value of the dollar has been declining, and there have been many predictions that it could become worthless in the future. This has led many to question what will happen to the global economy if the dollar does become worthless. One possibility is the emergence of a new global currency, such as the one being proposed by the BRICS countries.

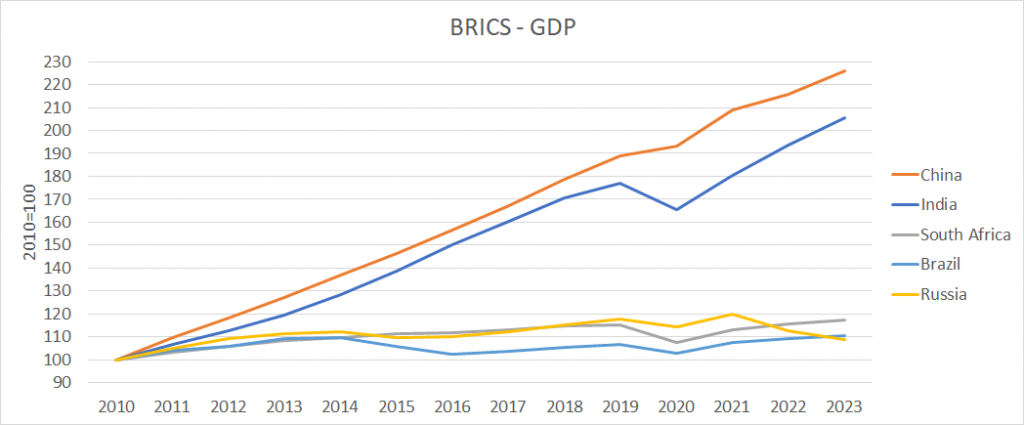

BRICS stands for Brazil, Russia, India, China, and South Africa. These countries have a combined population of over 3 billion people and account for nearly 25% of global GDP. In recent years, they have been working on creating a new currency that is backed by gold. The idea is to create a currency that is stable and not subject to the fluctuations that the US dollar is currently experiencing.

The BRICS new currency, which is backed by gold, could become the new global reserve currency. This would have significant implications for the world economy. If the dollar does become worthless, then countries around the world will need to find a new currency to use for international trade. The BRICS currency could fill this gap and become the new standard for international trade.

One of the advantages of a gold-backed currency is that it is stable. Gold has been used as a store of value for thousands of years and is not subject to the same fluctuations as other currencies. This means that the BRICS currency would be more stable than the US dollar, which is subject to the whims of the Federal Reserve and global market forces.

Another advantage of a gold-backed currency is that it is not subject to inflation. Inflation occurs when there is an increase in the money supply, which decreases the value of the currency. However, a gold-backed currency is not subject to this because there is a finite amount of gold in the world. This means that the BRICS currency would be more stable than the US dollar, which has seen significant inflation over the years.

The BRICS countries have been working on this new currency for several years. They have already established the New Development Bank, which is a development bank that is owned by the BRICS countries. This bank has been instrumental in providing funding for infrastructure projects in developing countries.

If the BRICS new currency does become the global reserve currency, it could have significant implications for the US economy. The dollar is currently the world’s reserve currency, and this has given the US significant economic advantages. However, if the dollar does become worthless, then the US would lose this advantage, and other countries could become more dominant in the global economy.

In conclusion, the BRICS new currency, which is backed by gold, could become the new global reserve currency. This would have significant implications for the world economy, and if the dollar does become worthless, then the BRICS currency could fill the gap and become the new standard for international trade. The advantages of a gold-backed currency are stability and protection against inflation, which could make the BRICS currency a more attractive option than the US dollar. The BRICS countries have been working on this new currency for several years, and if it does become a reality, it could have significant implications for the global economy.