The United States dollar has been the world’s dominant currency for decades, but with the rise of China’s economic power, there is growing speculation that the Chinese yuan may someday take over as the world’s reserve currency. While this outcome is not inevitable, there are several reasons why it could happen.

The Chinese Yuan’s Rise in International Trade

China has become the world’s second-largest economy, and its trade with other countries has grown rapidly. As a result, more countries are using the yuan to settle trade transactions. In 2016, the International Monetary Fund (IMF) included the yuan in its basket of reserve currencies, which is a major milestone for China. This move means that central banks around the world can now hold yuan as part of their foreign exchange reserves.

Furthermore, China has been actively promoting the use of the yuan in international trade. The country has established currency swap agreements with many countries, allowing them to conduct trade in yuan. Additionally, China has launched the Belt and Road Initiative, a massive infrastructure project that aims to connect China with countries across Asia, Europe, and Africa. This initiative is expected to increase trade between China and these countries, which could further boost the yuan’s international use.

China’s Strong Economic Growth

China has been experiencing rapid economic growth over the past few decades. The country’s GDP has grown at an average annual rate of around 6-8% over the past decade. This growth has been driven by a range of factors, including China’s large population, its manufacturing capabilities, and its investments in infrastructure and technology.

As China’s economy has grown, its influence on the global economy has increased. Some experts predict that China’s economy could eventually surpass that of the United States. If this were to happen, it could give the yuan even more weight as a global currency.

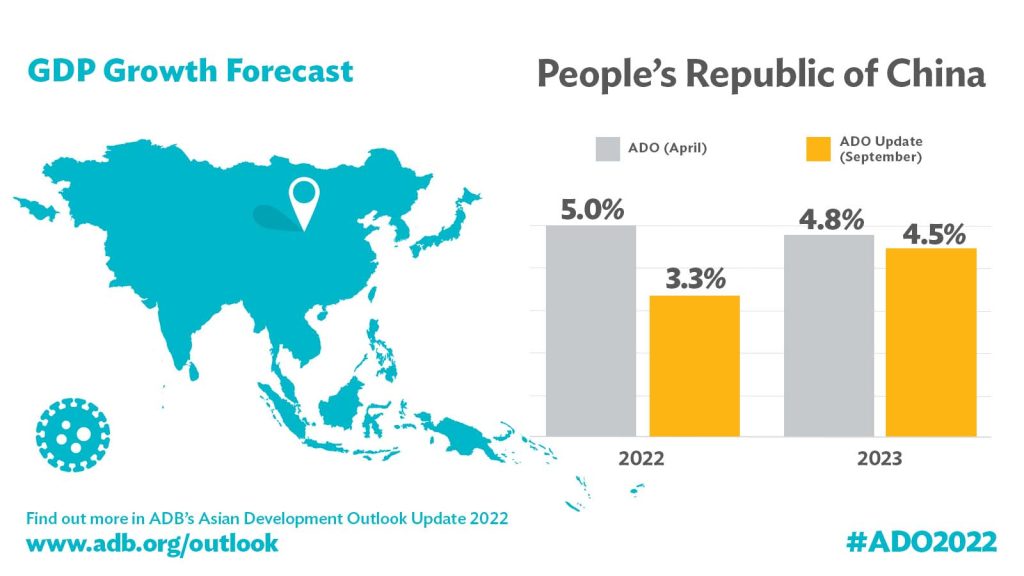

Read: Economic Growth in People’s Republic of China to Moderate to 3.3% in 2022

The United States’ Economic Challenges

While the Chinese yuan’s rise as a global currency is not inevitable, there are several factors that could make it more likely. One of these is the United States’ own economic challenges. The United States has been running large trade deficits for many years, which has led to a massive accumulation of debt. Additionally, the United States has been printing money to finance this debt, which has led to inflation and a devaluation of the dollar.

These economic challenges could make other countries more reluctant to hold US dollars as a reserve currency. If countries lose confidence in the dollar, they may start looking for alternatives. The yuan could be one of those alternatives, especially if China continues to grow its economy and promote the use of its currency in international trade.

Conclusion

In conclusion, the Chinese yuan has the potential to take over as the world’s reserve currency, although it is not inevitable. China’s growing economic power and influence, combined with the United States’ economic challenges, could make the yuan a more attractive option for central banks around the world. However, there are also several obstacles that China would need to overcome, including its own economic challenges and the need for greater financial openness and transparency. Ultimately, whether the yuan takes over as the world’s reserve currency will depend on a range of complex factors, including economic and political developments around the world.